Why I Stopped Ignoring Accident Insurance — A Real Talk on Staying Protected

You never think it’ll happen to you—until it does. I learned that the hard way when a sudden fall landed me in the hospital, racking up bills I wasn’t ready for. That’s when I realized: accident insurance isn’t about fear, it’s about control. It’s a smart, practical layer of financial backup that most of us overlook. In this article, I’ll walk you through why managing risk matters more than chasing returns—and how one simple move can shield your wallet when life throws a curveball. This isn’t about worst-case scenarios or scare tactics. It’s about recognizing that no matter how careful you are, accidents happen—and when they do, the financial fallout can be far more damaging than the injury itself. The truth is, most families are just one unexpected event away from financial strain. But with thoughtful planning, that strain doesn’t have to become a crisis.

The Wake-Up Call: When Life Interrupts Your Plans

It started with a misstep on a rainy sidewalk. A simple slip, nothing dramatic—just enough to twist my ankle and fall awkwardly. What followed, however, was anything but minor. An ambulance ride, X-rays, and a diagnosis of a fractured fibula led to a $4,200 medical bill, not counting follow-up visits, physical therapy, and the cost of crutches and a knee scooter. My health insurance covered about 70% of the hospital charges, but I was still left with hundreds in out-of-pocket costs, plus lost wages because I couldn’t drive or stand for long hours at work. That accident didn’t just hurt my leg—it shook my financial footing.

This experience wasn’t unique. Millions of people each year face similar situations: a kitchen burn, a hiking misstep, a car fender-bender that turns into a whiplash diagnosis. These aren’t rare catastrophes. They’re everyday events with outsized financial consequences. The Centers for Disease Control and Prevention reports that unintentional injuries are a leading cause of emergency room visits in the United States, with slips, falls, and motor vehicle accidents topping the list. And while most people carry health insurance, few realize how much it leaves uncovered—especially when it comes to emergency services, specialist visits, and non-hospital treatments like physical therapy or home modifications.

What struck me most was the gap between what I thought was covered and what actually was. I assumed my insurance would handle the big expenses, and it did—partially. But the smaller, cumulative costs added up fast: the rideshare to appointments, the prescription pain relievers, the days I had to take off without paid leave. These are the hidden drains that can erode a family’s budget in weeks. That’s when it hit me—risk protection isn’t just for extreme scenarios. It’s for the ordinary moments that go wrong. Accident insurance exists to fill this very gap, not as a replacement for health coverage, but as a complement. It’s designed to pay cash benefits directly to you after a covered incident, helping cover both medical and non-medical costs, so you’re not choosing between recovery and financial stability.

What Accident Insurance Really Is (And What It Isn’t)

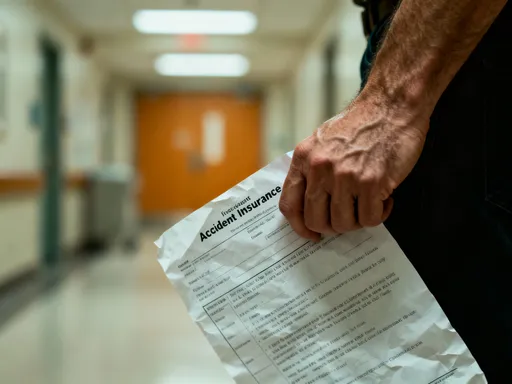

At its core, accident insurance is a supplemental policy that pays a lump sum or scheduled benefit when you suffer a covered injury due to an accident. Unlike health insurance, which reimburses providers for services rendered, accident insurance gives you cash. That money can be used however you need—toward medical deductibles, transportation, childcare, or even mortgage payments if you’re unable to work. It’s not a cure-all, nor is it meant to replace comprehensive health coverage. Instead, it’s a targeted financial safety net for the specific risks that come with daily life.

For example, if you break a bone, the policy might pay $1,500. If you require emergency surgery, it could provide $5,000. Some plans even offer smaller payouts for less severe events like stitches or dental injuries from a fall. These amounts vary by provider and plan, but the principle remains the same: immediate financial support when an accident disrupts your routine. This is especially valuable for people with high-deductible health plans, where out-of-pocket costs can reach thousands before insurance kicks in.

It’s important to clarify what accident insurance does not cover. It won’t pay for illnesses like heart attacks or strokes unless they result directly from a documented accident. It doesn’t cover routine checkups, mental health services, or chronic conditions. And it’s not life insurance—it won’t provide a death benefit to your family. Some people confuse it with disability insurance, but the two serve different purposes. Disability insurance replaces a portion of your income if you’re unable to work due to illness or injury, often requiring medical proof of long-term impairment. Accident insurance, on the other hand, pays out quickly after a qualifying event, regardless of your ability to return to work, and the funds are yours to use freely.

Another common misconception is that employer-provided benefits make personal accident coverage unnecessary. While some jobs offer group accident insurance, the coverage is often limited in scope and amount. It may not follow you if you change jobs, and the benefits might not keep pace with rising living costs. Relying solely on workplace plans can leave you underprotected, especially if you have dependents or financial obligations. Accident insurance is not about fear-mongering—it’s about closing the gaps in your existing safety net with a practical, affordable tool.

Why Risk Management Beats Return Chasing

Most financial advice focuses on growth: how to invest, how to save, how to earn more. And while building wealth is important, protecting what you already have is just as critical. Think of it this way: earning a 7% annual return on your portfolio means little if a single accident wipes out six months of savings. Risk management isn’t glamorous, but it’s foundational. It’s the difference between steady progress and sudden setbacks.

Consider two households with similar incomes. One invests $100 a month into a retirement account, earning steady returns over time. The other does the same but also allocates $25 a month to accident insurance. Both are saving and planning for the future. But when an unexpected injury occurs—say, a child’s playground fall requiring surgery—the second household has an extra $3,000 in cash benefits to help cover costs, while the first may have to dip into emergency savings or use a credit card, potentially derailing their financial goals. Over time, the ability to absorb shocks without debt or disruption becomes a form of financial resilience that no investment return can match.

This isn’t about pessimism. It’s about probability. The National Safety Council estimates that Americans have a 1 in 10 chance of suffering a disabling injury each year. That’s not a remote risk—it’s a real possibility. And while we can’t predict when or how an accident will happen, we can prepare for its financial impact. Just as homeowners insurance doesn’t prevent fires but helps you recover from them, accident insurance doesn’t stop falls or car crashes, but it reduces their financial toll.

The real return on investment here isn’t measured in interest rates or stock gains. It’s measured in peace of mind, in the ability to focus on healing rather than bills, in the confidence that a setback won’t become a financial spiral. In a world where many financial strategies focus on the future, accident insurance is a safeguard for the present. It ensures that the progress you’ve made—paying down debt, building savings, planning for retirement—isn’t undone by a single unexpected event. Smart financial planning isn’t just about climbing the ladder. It’s about making sure the ladder doesn’t collapse beneath you.

Who Actually Needs Accident Coverage? (Hint: Probably You)

Some people assume accident insurance is only for high-risk jobs or extreme sports enthusiasts. But the reality is, everyday life carries risk for everyone. Whether you’re a parent chasing a toddler, a remote worker climbing a step stool to change a lightbulb, or a retiree gardening in the backyard, accidents don’t discriminate. The people who benefit most from this coverage are often those who underestimate their exposure—especially those who are healthy, active, and already insured.

Young professionals, for instance, may have good health insurance through their employer but lack substantial emergency savings. A broken wrist from a bike accident could mean weeks of lost income if they’re hourly workers or freelancers. Parents face additional layers of risk—not just for themselves, but for their children. Kids are naturally prone to bumps, burns, and falls, and while pediatric care is often covered, co-pays and specialist visits add up. A family policy that includes child coverage can provide crucial support during stressful times.

Gig economy workers—rideshare drivers, delivery couriers, freelance contractors—often operate without traditional employer benefits. They don’t have paid sick leave or disability coverage, making them especially vulnerable to income loss after an injury. For these individuals, accident insurance can act as a form of self-protection, offering a financial buffer when work stops but bills don’t. Similarly, frequent travelers, whether for business or leisure, face increased exposure to accidents in unfamiliar environments. A slip in a hotel bathroom or a rental car collision abroad can lead to costly medical evacuations or extended stays, many of which may not be fully covered by travel or health insurance.

Even retirees aren’t immune. Falls are a leading cause of injury among older adults, and recovery can be lengthy and expensive. Medicare covers many medical services, but it doesn’t pay for all accident-related costs, especially non-medical expenses like home modifications or transportation. Accident insurance can help bridge that gap, preserving retirement savings for their intended purpose. The common thread across all these groups is not high risk, but high consequence. It’s not about how likely an accident is, but how much it would cost if one occurred. And for most families, the cost—financial and emotional—can be significant.

How to Choose Without Getting Played

Not all accident insurance policies are created equal. Some offer broad coverage with clear benefits, while others are filled with exclusions and fine print that limit payouts. Choosing the right plan requires careful attention, not just to the price, but to the details of what’s covered, how benefits are paid, and what situations are excluded. The goal is to find a policy that aligns with your lifestyle and financial needs, not one that sounds good in an advertisement.

Start by reviewing the coverage scope. Does the policy cover common accidents like fractures, burns, lacerations, and dislocations? Are emergency room visits included? Some plans pay a benefit just for being admitted to the ER, which can help offset initial costs. Look for policies that offer tiered payouts—higher amounts for more serious injuries—so the benefit scales with the severity of the incident. Also, check whether the policy covers accidental death or dismemberment, which can provide additional protection for your family.

Next, examine the payout structure. Is the benefit paid as a lump sum, or in installments? Lump sum payments are generally more useful because they give you immediate access to funds when you need them most. Some policies pay benefits directly to you, while others may require you to submit claims with documentation. A streamlined claims process is essential—look for insurers with a reputation for quick, hassle-free payouts.

Equally important are the exclusions. Most policies won’t cover injuries from illegal activities, war, or self-harm, which is standard. But some may exclude high-risk hobbies like skydiving or professional sports unless you pay extra. Others may have waiting periods or limits on pre-existing conditions. Read the fine print carefully. Also, consider network restrictions. Unlike health insurance, many accident policies don’t require you to use in-network providers, giving you more freedom in how you receive care. This flexibility can be a major advantage, especially in emergencies.

Finally, avoid being lured by flashy marketing. Phrases like “complete protection” or “maximum coverage” can be misleading without specifics. Focus on real benefits, not buzzwords. Compare policies from reputable insurers, check customer reviews, and consider working with a licensed financial professional who can help you evaluate options without pushing a commission-based product. Choosing accident insurance isn’t about buying the cheapest plan—it’s about buying the right one.

Integrating Protection Into Your Financial Plan

Accident insurance shouldn’t stand alone. It works best as part of a broader financial strategy that includes emergency savings, health insurance, and, where applicable, disability and life insurance. Think of it as one layer in a multi-tiered safety net. Each component plays a different role, and together, they create a more resilient financial foundation.

Start with your emergency fund. Financial experts often recommend saving three to six months’ worth of living expenses. That fund is your first line of defense against unexpected costs. But what happens when a medical emergency drains that fund in weeks? Accident insurance can help preserve those savings by providing immediate cash to cover out-of-pocket expenses, reducing the need to liquidate investments or go into debt.

Next, align accident coverage with your health insurance. If you have a high-deductible plan, you’re more exposed to upfront medical costs. A cash benefit from an accident policy can help you meet that deductible faster, allowing your primary insurance to kick in sooner. If you have a flexible spending account (FSA) or health savings account (HSA), you can use those for qualified medical expenses, but they don’t cover non-medical costs like transportation or lost wages. Accident insurance fills that gap.

For families, this integration is even more critical. A financial plan that includes protection for all members—spouse, children, even pets in some cases—ensures that no single event destabilizes the household. Consider conducting a simple risk assessment: What are the most likely accidents in your daily life? What would the financial impact be? How much would you need to cover deductibles, co-pays, and lost income? Answering these questions helps you determine the right level of coverage without over-insuring or under-insuring.

The goal isn’t perfection. It’s preparedness. You don’t need to predict every possible scenario. You just need to build a system that can absorb shocks without collapsing. When protection is woven into your financial plan, it becomes invisible in good times and invaluable in bad ones.

Peace of Mind Is the Best ROI

At the end of the day, financial success isn’t just about how much you earn or how much you invest. It’s about how secure you feel. It’s the quiet confidence that comes from knowing you’re prepared—not because you expect the worst, but because you respect the unexpected. Accident insurance offers more than cash benefits. It offers clarity. It offers control. It offers the freedom to focus on what matters most: your health, your family, your recovery.

In a world that glorifies hustle and growth, protection is often overlooked. But the smartest financial decisions aren’t always the loudest. They’re the ones that prevent setbacks, preserve progress, and protect peace of mind. Treating risk management as a core part of your financial life—not an afterthought—changes how you see money. It shifts the focus from chasing returns to building resilience.

You don’t need to be wealthy to benefit from accident insurance. You just need to value stability. Whether you’re starting a family, building a career, or planning for retirement, the ability to withstand life’s surprises is a form of wealth in itself. And that’s a return worth investing in.